Exports have become an important starting point for the steady development of the construction machinery industry in 2023. The monthly export volume of some equipment has exceeded domestic sales for many consecutive months. The importance of overseas markets to my country's construction machinery industry continues to increase. However, from the perspective of export structure, the penetration rate of my country's construction machinery in mainstream markets such as North America and Europe is limited, which may not be conducive to the long-term export resilience of the construction machinery industry. This article will break down the demand for construction machinery in the North American market and review the overseas expansion path of the leading company Komatsu, providing a reference for the next step of Chinese construction machinery companies' layout of overseas markets.

01Insufficient development of mainstream markets and unstable construction machinery export market structure

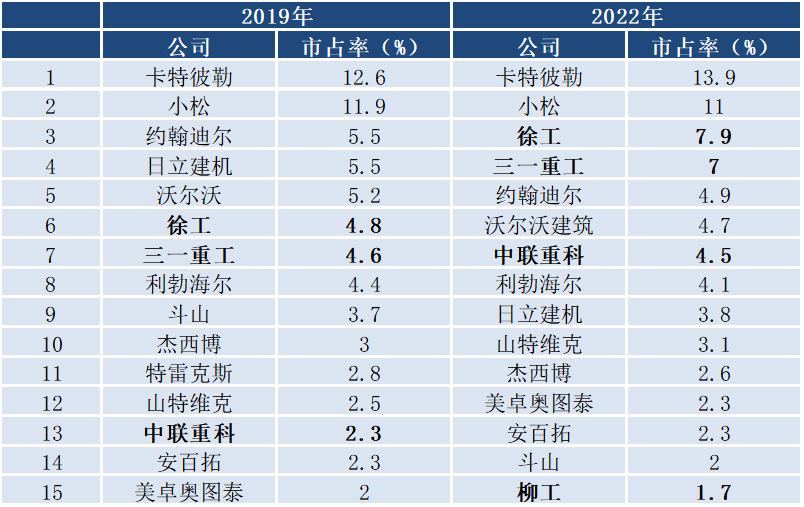

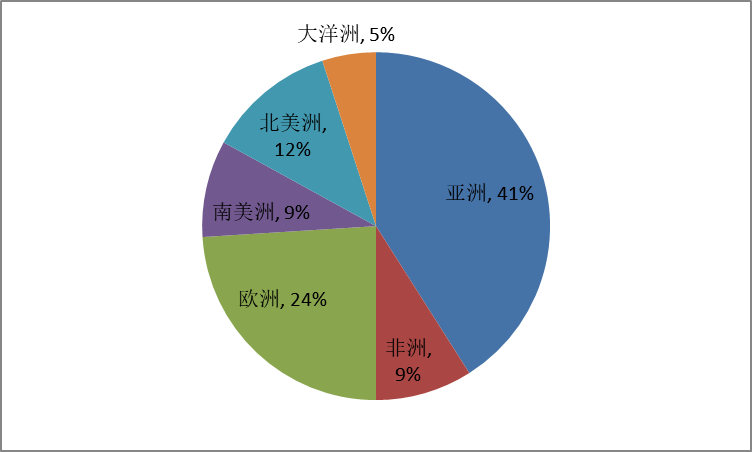

In the past 20 years, the global construction machinery market pattern has undergone tremendous changes, the most obvious of which is the rise of Asian brands represented by China. From 2004 to 2023, Asia's construction machinery market share in the global market has increased from 30.4% to nearly 30.4%. 45%, corresponding to the decline in the market share of North American brands, from 43.3% to about 27% during the same period (the other major branch, European brands, rose from 25.9% to about 27%, basically remaining stable).

The increase in the market share of Asian construction machinery brands is mainly due to the rise of Chinese brands. In the past 20 years, my country's global construction machinery market share has increased from less than 5% to 20% (Japanese brands have dropped from 21.1% to 20.9%, and Korean brands have increased from 2.2% to 5.7%). The 2008 financial crisis, the supply-side structural reform in 2017, and the global supply chain fluctuations during the 2020 epidemic have become important factors affecting the development pattern of the industry. A number of construction machinery leaders such as XCMG, Sany, and Zoomlion have fully grasped these key nodes and accelerated Expand into global markets.

However, as the supply of overseas brands gradually recovers in 2023, the market share of domestic brands has declined. This is directly related to the fact that the product strength of our country's engineering machinery and equipment is still far behind that of advanced products and the lack of development of the leading market, resulting in the The position of machinery brands in the global competitive landscape is not stable.

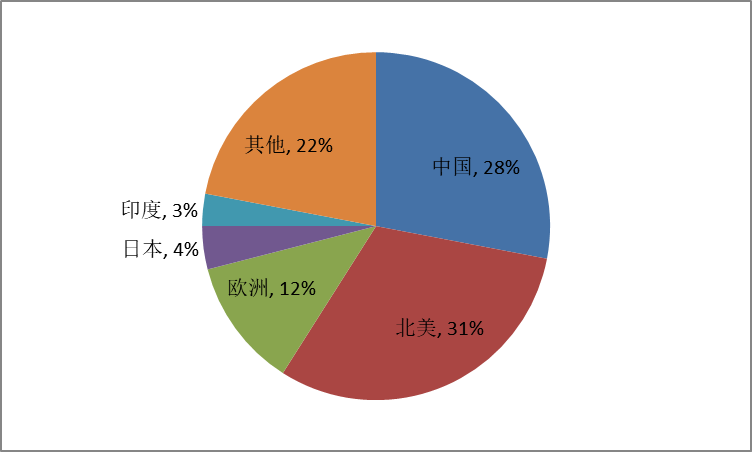

From the perspective of export regional distribution, countries along the “Belt and Road” and BRICS countries are important markets for my country’s construction machinery exports, accounting for a relatively high proportion of export scale. Since the "Belt and Road" initiative was proposed, my country's construction machinery companies have actively deployed in countries along the route and established industrial parks or production bases in Belarus, Kazakhstan, India, Pakistan, Indonesia, Thailand and other countries to achieve "go-in" localized operations. Implementation of overseas development strategy. In recent years, the proportion of my country’s construction machinery sales to countries along the “Belt and Road” has been stable at around 40% of exports.

From the perspective of global construction machinery market distribution, Europe and the United States are still the mainstream markets in the world. The combined market share of North America and Europe is close to 45%. However, the penetration rate of Chinese construction machinery in large markets such as North America has always been low. The European and American markets pay more attention to product strength, and the market is dominated by demand for high-end excavators. Caterpillar and Komatsu occupy a major share of the European and American markets, which is also the main factor why these two companies have occupied the top position in the industry all year round. Although Chinese products have cost-effective advantages, there is still a certain gap between them and high-end brands in terms of service life and mean time between failures. The Biden administration issued new regulations last year to gradually increase the proportion of U.S.-made parts and components in the federal government's "domestic procurement" from 55% in 2022 to 75% in 2029, aiming to rebuild the United States with U.S.-made equipment and parts. . With the release of domestic production capacity in the United States, Chinese manufacturers may face more severe competitive pressure.

Figure 2: Global construction machinery market composition (amount basis) (Unit: %)

Figure 3: China’s construction machinery export market composition in 2022 (in terms of monetary value)

(unit:%)

02 Mineral mining + facility construction, demand for construction machinery in North America is still strong

North America is the most important construction machinery consumer market in the world. The active construction activities in the United States and Canada, abundant energy and mineral resources, high labor costs, and the full support of the financial industry for the construction and mining industries have all contributed to the engineering machinery industry. The development of the machinery industry in this region provides relatively favorable conditions. At the same time, with the return of manufacturing and increased investment in infrastructure facilities in recent years, demand for construction machinery in North America continues to remain strong. In the competition pattern of the construction machinery industry in North America, the entry barriers for agricultural machinery are relatively high, and an oligopoly has formed. However, in the fields of mining equipment and construction equipment, the industry competition pattern is relatively fragmented. Mining equipment and construction equipment may be the dominant players in my country. An important starting point for breakthroughs for construction machinery companies.

In terms of mining industry, North America is rich in mineral resources and has strong development capabilities. According to 2018 data, the U.S.’s trona reserves account for 92.8% of the world’s total reserves. Coal and molybdenum reserves also account for 23.7% and 15.9% of the world’s total reserves respectively. Natural gas, gold, copper and other reserves are also very abundant. Against this background, the United States has long-term and stable demand for mining equipment. In recent years, the penetration rate of new energy vehicles and electrochemical energy storage has continued to increase. Relevant companies have increased their efforts in the layout of the upstream and downstream industrial chains. Lithium ore resources have received widespread attention from companies. Salt lake brine and hard rock minerals are the main sources of lithium resources. Among them, spodumene is mainly distributed in Australia, the United States and Canada, and salt lake brine is mainly distributed in Argentina, Chile and the United States. It can be seen that the United States has very rich lithium resources (the world has The distribution of proven lithium resources (the United States accounts for about 9% and Canada accounts for about 3%). As the global demand for lithium resources continues to increase, North American mining projects will continue to generate demand for mining machinery.In terms of agriculture, agricultural machinery and equipment have always had a wide market in North America. North America has a high level of modernization, and agricultural machinery has the characteristics of mechanization, electrification, and chemicalization. At the same time, North America is an important producer of corn, wheat, rice and other grains, and is also widely planted with cotton, soybeans, sugar beets and other cash crops. The region has a high usage rate of agricultural machinery such as tractors, and also attaches great importance to the performance of agricultural machinery. Against the backdrop of rising labor costs, the United States has a clear need to improve the technical level of agricultural machinery. The average annual hourly wage for field and livestock workers in the United States increased by 7% year-on-year in 2022, reaching $16.62/hour. The Canadian Agricultural Human Resources Council also mentioned that the shortage of Canadian agricultural labor in 2029 is expected to double from 2021 to 123,000. Although the market space is vast, considering the competitive pattern of the agricultural machinery industry in North America (CR4 reached 83.6%, John Deere 45%, Kubota 15.3%, CNH 15.3%, AGCO 8%), the agricultural machinery equipment of domestic engineering machinery companies It may be difficult to enter this market.